If you haven’t yet read Part I: Introduction to Personal Finance, please do so before continuing.

Getting Started With Your New Application

So now you’ve picked an app, what’s next? Well once you link up your bank accounts and credit cards, you’re going to want to start categorizing transactions (Mint does most of this work for you, which is nice). In the beginning, this will take some time, but over time, your app will do most of this work for you. It will automatically recognize and label vendors that you’ve categorized before.

Categorizing is where the real power of budgeting apps comes into play. It’s also the reason I prefer the proprietary programs to mint.com. You just have more category customization at your fingertips. With mint, you cannot create parent categories, however, you can create subcategories.

Categories – The Rules

When you start a budget for the first time, it’s a good idea to keep everything as simple as possible. Over time you will most likely want to see more detail in certain categories, or be able to break out your categories into sub-categories – especially if you want to cut back on certain things (e.g. dining out.)

So to start, you may want to stick with these very basic top level categories:

- Housing

- Utilities

- Food

- Transportation (Car payments, gas, insurance, bus/subway fare)

- Clothing

- Personal (things like life insurance, hair care, medical expenses)

- Education (tuition, daycare fees, school supplies)

- Savings

After a while though, you WILL want more detail, and end up making subcategories to give you the desired detail to make planning ahead more effective.

When it comes to categorizing your expenses, I have two rules that I follow:

1. Be as specific as possible to the point of usefulness.

Quite simply put, to get the most use out of categorizing your expenses, you need to be specific. Of course, you’re going to have some miscellaneous expenses which just don’t garner their own categories. I mean, how else do you categorize the losses for that bet you made about how old your bosses daughter is? (Answer: not old enough.) But if 30% of your expenses are labeled as ‘misc’, you cannot budget effectively. Personally, I aim for no more than 1% of my yearly expenses to be categorized as ‘misc’, but I think it’s okay if your numbers are closer to 5%. Once you get into double digits though, you definitely want to start looking for trends that you can break off into their own categories.

On the same hand, having so many categories that your categories overlap and are unnecessary will make it more difficult to set up a budget and make your reports less cohesive, less useful and more difficult to read. Of course, there will be some exceptions, things you’ll want to track very specifically, but the general idea is to be specific, but not anal.

2. Separate your fixed expenses from your extraneous expenses.

Fixed expenses includes federal, state and Social Security taxes, insurance, regular bills and living expenses- like food and clothing, car and housing payments. These are bills you HAVE to pay each month, things you should prioritize in your budget. Extraneous expenses are those irregular expenses or things that are just not necessities. Things like dining out, auto upgrades, alcohol and entertainment. In my budget construct, it is important to categorize the extraneous expenses, find the fat, or that which can be cut, and learn how to cut it.

An example is ATM fees. I would bet that it’s quite common for people to spend well over $100 a year in ATM fees. Tracking your expenses and getting feedback on such a thing will reinforce positive habits like keeping cash on hand.

Ultimately, that is the goal – creating a positive feedback loop where you have input, output, and learned behaviors. Input: entering/categorizing data. Output: reports & budgets. Learned behaviors: recognizing good and bad trends and capitalizing/correcting them.

Examples From the Real World

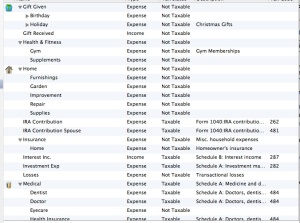

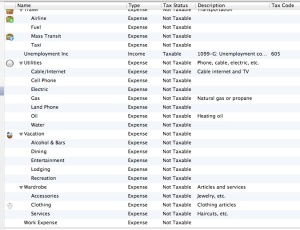

Here are screen shots of my categories. I’ve expanded all the subcategories that I deemed important. Note that some of the categories were stock categories in my program (iBank) and not actually used (i.e. Property Taxes). You will note that some categories have several subcategory levels. These are generally areas which I keep a close eye on in my budget.

Obviously, you will have many different categories than I have, but this should at least give you an idea of how to structure things. You’ll notice I get VERY specific with my Recreational exploits. This is because they are expensive! And I find that being this specific helps me to plan ahead much better when I’m putting together my budget.

If you choose to use Mint.com, you cannot change the top level categories that they give you. That is my ONLY gripe with mint.

Tips to Help You Along

- A great way to get started is to switch ALL of your spending over to your credit/debit cards for the first month. This will allow all of your regular spending to automatically wind up into your system. If you elect to use Mint.com, it will have the added bonus of categorizing EVERYTHING for you. If not, in most applications, you only have to categorize a vendor once anyway, and the next transaction is automatically labeled for you.

- Switching the majority of your spending to credit cards has the added bonus of earning you rewards points (or whatever it is your rewards offer). This also alleviates the manual entry for cash transactions. Reviewing your transactions often (once a week is good) will keep you from over spending.

- Some things you will inevitably need to use cash for, and you WILL forget transactions from time to time. It happens. When this happens to me, I do a balance adjustment and label it in the ‘misc’ category. Easy!

- I tend to use cash for certain types of transactions ONLY (such as bars, coffee shops, and dining out), so if I do miss a transaction and fail to realize it, it’s usually not hard to figure out what it was spent on anyway (that fourth shot at the bar, maybe?)

- When entering cash expenses, always round up, and just save your change in a change jar. Tracking cents will drive you crazy. And not the good kind of crazy, either.

~~~

Using these guidelines, tracking expenses becomes very simple yet extremely effective. I’ve been refining my methods for about four years, and this is ultimately what I have found to be the most effective means of tracking expenses which will actually result in very useable data.

As always, feel free to leave a comment below if you liked, hated or just have a question about this post! And once you’re ready, please visit Part III – Building a Budget, where everything comes together…

I’m just starting to use ibank. I have all my accounts set up. What confuses me about the categories and the budget system is that I can’t add an existing account as a category. For example: Credit card payment. I want the category to be Chase, not credit card payment. But in my register lists for my checking account I enter the payment from Checking and in the category I put Chase so It will enter the transaction in the Chase register as well. This leaves out credit card payment for my budget category and then it doesn’t track it. I hope that makes sense…

Do I just budget for my non-fixed expenses such as groceries and gas and leave the fixed expenses out?

No. In iBank you have to exclude the account from your budget so that you can track it as an expense. If you double click on the budget in the left pane (where it’s name appears) it will show you which accounts you are tracking in your budget. Uncheck your “Chase” account. This will allow you to select it as an expense when you create a new budget item (with the “+” button at the bottom of the budget screen.)

If you are only paying off your credit card, this may work well for you. However, if you are using it every month for expenses (such as groceries, etc.) then it will create some issues because now you can only track the payment, and not the actual expenses that you tracked on the card itself. If you tracked both, you would be tracking your expenses twice, and therefore falsely reporting double the expenses you actually incurred.

Think of it this way, you can either track an account by breaking down it’s activity by category (include it as a budgeted account i.e. check it’s box) or you can track all activity to an account as a single budgetary item (track it as a line item in the budget i.e. uncheck it’s box.)

It’s a tradeoff. In my budgets I include my income and expense accounts only, and I track my other accounts as expenses. For example, I uncheck my savings account so I can track all it’s activity in my budget as an expense, and plan my other expenses around what I want to save each month. However, that means I can’t track the income from my Savings interest payments as income, it will just reduce the overall “expense” tracked in my budget.

I hope that makes sense, feel free ask if you there is anything more I can help with!